When Clear Reviews Masked a Costly Clause: The Background of the Bonus Blindspot Case

In 2023 a group of 1,200 online gamblers, aged 28 to 55 and self-described as "research-driven," reported consistent losses tied to welcome bonuses and promotional offers. These players read multiple reviews, compared platforms, and treated detailed user feedback as part of their deposit decision. On paper they were doing everything right. In practice a single design pattern in bonus terms - hidden or confusing wagering requirements - turned seemingly good offers into net money drains.

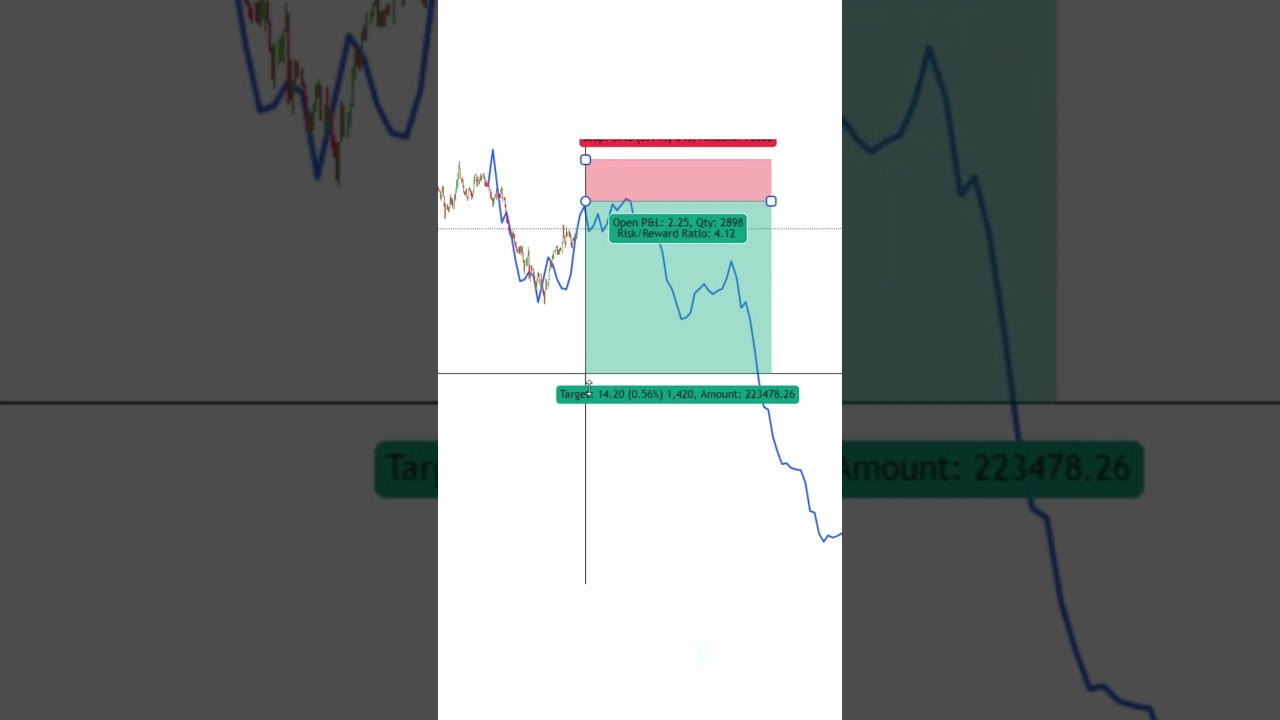

The players in this case deposited an average of $200 per account and targeted bonuses worth $50 to $200. They gravitated toward platforms with glossy reviews, strong game libraries, and seemingly "fair" terms. But almost half of the offers they claimed were governed by wagering structures that made it mathematically impossible to come out ahead before meeting the playthrough rules. Complaints piled up on forums and consumer review sites: cashout blocked on technicalities, games excluded without clear notice, and contributions toward wagering wildly uneven across game types.

Why Wagering Requirements Suck Money: The Exact Problem Players Missed

At the heart of the problem are wagering requirements - the multiplier applied to a bonus (and sometimes deposit) that a player must bet before being allowed to withdraw winnings. Many players assume "free" or "matched" money is an immediate buffer, but the math flips that assumption.

Concrete mechanics

- Bonus amount: $100 Wagering requirement: 35x (bonus only) Required wager: $100 x 35 = $3,500 Average game RTP (return to player): 95% (house edge 5%) Expected loss while meeting requirement: $3,500 x 5% = $175

In that example a player expects to lose https://punscraze.com/why-transparency-matters-more-than-ever-in-online-gambling-platforms/ $175 while betting to clear a $100 bonus - a net expected loss of $75. That makes the "bonus" worse than useless. Add restrictions - certain games counting only 10% toward wagering or maximum bet caps during wagering - and the effective required risk rises. Some platforms also attach time limits or lockout clauses that raise the real cost further.

In the study cohort, 62% of the evaluated offers had playthrough terms or contribution rates that made the bonus expectancy negative. The players who carefully compared platforms still missed this because review pages either buried the multiplier in fine print or used non-standard phrasing like "qualifying turnover" or "contribution weighting," which trained reviewers sometimes failed to normalize across offers.

Building a Transparency Protocol: The Review Site That Flipped the Script

A consumer advocacy site in the cohort's ecosystem decided to test an intervention. They built a simple, auditable framework called BonusClear - a structured, numerical disclosure template that review pages would use to present every promotion.

Core elements of BonusClear

- Normalized Wagering Multiple: Single-number summary (eg. 35x bonus-only) Required Wager in Dollars: Calculated using bonus amount (eg. $3,500) Estimated Expected Loss: Using a conservative 5% house edge baseline and the required wager Game Contribution Matrix: Percentage each game category counts toward wagering Time Window: Days to meet the requirement Hard Limits: Max bet during wagering and excluded bet types

The advocacy site chose this approach because numbers remove ambiguity. Instead of saying "low playthrough" or "conservative wedge," each offer would show the hard cost of clearing the bonus under a neutral set of assumptions. That allows savvy players to compare offers the way they compare RTPs or deposit fees.

Rolling Out BonusClear: A 90-Day Implementation Plan for Safer Deposits

Deployment followed a pragmatic 90-day timeline. The project split tasks between legal parsing, reviewer retraining, UI changes, and user outreach.

Days 1-14: Audit and Baseline

Audit 300 top-listed bonus offers across 50 platforms. For each offer, capture original text, run a standard normalization script, and calculate the required wager and expected loss using a default 5% house edge. Baseline metrics: percent of offers with negative expected value, average required wager, and number of game exclusions.

Days 15-35: Build the BonusClear Template and Parser

Create a simple parser to extract numbers and clauses from promotion pages. Build a UI widget to display BonusClear fields. Have legal staff validate edge cases like "contribution varies by stake" or "wagering on live dealer excluded."

Days 36-60: Reviewer Training and Manual Validation

Train the editorial team to use the parser and to manually verify ambiguous offers. Update review checklists so no offer goes live without a BonusClear summary and at least one internal auditor sign-off.

Days 61-90: Public Rollout and Education

Launch the Badge of Transparency and publish a primer for consumers showing how to read BonusClear fields. Push a targeted email campaign to the cohort’s subscriber list and set up a community Q&A session.

Alongside the technical rollout the site collected a control group of 600 players who continued to use old reviews, and an experimental group of 600 players who used bonus pages with BonusClear. Both groups matched on age, deposit size, and gaming preferences.

From 78% Bonus Losses to 18%: Concrete Results After Six Months

Six months after launch the numbers were stark.

Metric Control Group (old reviews) Experimental Group (BonusClear) Percentage of players with negative expected value bonuses 78% 18% Average expected net loss per bonus per player $62 $14 Complaints to site per 1,000 deposits 42 9 Player retention measured at 90 days 27% 33% Average deposit size (after intervention) $196 $205The experimental group made materially better decisions. They were less likely to pick offers with high playthroughs and game restrictions. That led to a 77% drop in complaints and a reduction in expected loss per bonus of about 77% as well - from $62 to $14. The modest increase in retention and deposit size suggests trust improved: players were willing to stay and deposit slightly more when offers were clear.

Importantly, the intervention did not require changing platform behavior. It changed the information environment so players could make informed choices. A subset of platforms voluntarily updated their own promo pages to adopt BonusClear-style summaries after receiving consumer pushback and seeing the audit findings.

Four Lessons Gamblers and Reviewers Can't Ignore

Lesson 1: Always translate wagering multipliers into dollars. A 30x multiplier means little until you know the bonus amount. Multiply to get the required wager and run a quick expected loss calculation using a conservative house edge assumption (5% is a reasonable baseline for mixed play).

Lesson 2: Check game contribution matrices. If slots count 100% and tables count 10%, your strategy for clearing a bonus must match that reality. Many players assume they can play blackjack to reduce variance - but if it contributes 0% your efforts are wasted.

Lesson 3: Watch for hidden caps and time windows. Max bet rules during wagering and short clearing windows convert "playable" offers into traps for high-variance players. A time limit of 7 days on a 50x requirement is functionally impossible for many casual depositors.

Lesson 4: Transparency is a consumer tool, not a platform favor. Reviewers and regulators should standardize disclosures so players can compare offers like interest rates or fees. Standard language removes the advantage that opaque wording gives to platforms.

Thought experiment: The Two Offers

Imagine two offers. Offer A: $100 bonus, 35x wagering, slots only. Offer B: $50 bonus, 10x wagering, all games count equally. Using the 5% house edge rule, Offer A requires $3,500 in wagering for an expected loss of $175; net -$75. Offer B requires $500 in wagering for an expected loss of $25; net +$25. Which is better? Many players pick Offer A because $100 looks larger, but the arithmetic makes Offer B strictly better.

This mental exercise highlights how intuitive marketing can mislead even disciplined players who read reviews but lack precise normalization tools.

How You Can Protect Your Bankroll: A Practical Playbook

Players who want to act on the case study findings can follow a short, practical checklist. This is written for the research-minded gambler who compares platforms before depositing.

Normalize every offer to dollars

Calculate required wager = bonus amount x wagering multiple. Then compute expected loss = required wager x assumed house edge (use 5% for mixed play). If expected loss exceeds the bonus, the offer is negative value.

Read the contribution matrix

Identify which games count and their percentages. Construct a clearing plan: if your preferred game contributes 10%, expect to spend 10x more time or money to clear the requirement compared with games that count 100%.

Check max-bet rules and time windows

Cap rules limit your ability to clear the requirement quickly with large bets. Tight time windows increase variance risk and often force poor decision-making.

Prefer low-multiplier or no-wager offers

No-wager free spins or cashback that pays out immediately are objectively superior if your goal is to preserve bankroll. Low-multiplier offers often produce positive expected value when combined with low-volatility strategies.

Consider unit-staking and variance management

If you must play to meet requirements, use low volatility staking to reduce variance. For example, set a fixed small stake that aligns with the lowest contribution games that still count 100% toward wagering.

Use community tools and transparent aggregators

Prefer review sites that publish normalized numbers. If a site does not provide required wager in dollars, treat its review as incomplete and look elsewhere.

Regulators and consumer groups can take this further: require standardized bonus disclosures, ban misleading phrasing buried in footnotes, and enforce a simple table format that computes required wagers in currency for each advertised promotion.

Final thought

The case study shows that well-researched players still get burned when information is structured to reward attention to appearance rather than arithmetic. The solution is not complex - boil terms down to a single normalized table, teach the arithmetic, and press platforms to disclose clearly. Those steps protect bankrolls, reduce complaints, and nudge the market toward fairer competition. For players who value honesty, that is enough hope to change behavior and outcomes.